Quality advice for a secure retirement

Sasfin's asset consultants provide independent investment advisory services tailored to retirement funds. We assist trustees in fulfilling their fiduciary responsibilities by delivering clear, actionable strategies to achieve optimal retirement outcomes for fund members. Our advice is fully aligned with your objectives, ensuring impartiality and trust.

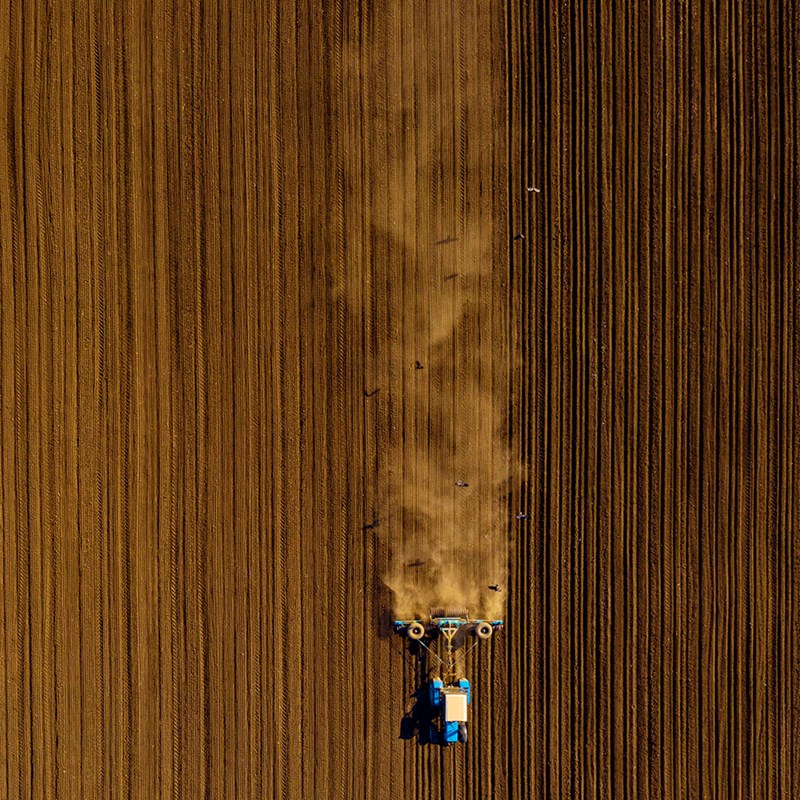

Our approach prioritises sustainability, ensuring that our long-term investment strategies deliver meaningful impact. As your trusted partners, we are committed to guiding you through complex challenges while protecting the trust we build, helping secure a positive future for your retirement fund.

Let's talk

Watch the video below to learn more about our offerings

Why we are the right advisor for your fund

Our investment advisory services

- Establishing the unique investment objectives and needs

- Asset and liability modelling and matching

- Investment strategy design and implementation

- Economic, market and investment performance overviews

- Annual investment strategy reviews and policy updates

- Trustee and member training and communication

- Regulatory and industry updates

- Investment compliance monitoring

- Net Replacement Ratio reporting at a fund and member level

Our investment advice philosophy and approach

We do a proper needs analysis in order to have a complete understanding of the investment objectives and goals that a fund seeks to achieve. Objectives can be set at portfolio level in peer relative and absolute terms as required.

We apply an implemented consulting advice model using Sasfin managed multi-strategy and multi-managed investment building blocks. If required, bespoke investment advice solutions are designed for clients using third-party building blocks.

Our default life stage model seeks to maximise the capital growth opportunity of each member pre-retirement. This is achieved by ensuring that each member is exposed to the appropriate amount of investment risk given their investment horizon and the nature of the annuity to be purchased at retirement.

We do not view active and passive investing as two mutually exclusive investment strategies, but rather seek to optimise the use of both strategies from a portfolio diversification and cost efficiency perspective.

We view return and risk as two sides of the investment performance coin. Measuring performance and making performance comparisons includes the important element of risk-adjusted returns.

When designing investment strategies, the investment objectives of clients are expressed in real terms over relevant rolling return periods.

We are not only concerned about the retirement benefits that members accumulate for retirement, but also about the society and environment that they will live in by focusing on socially responsible investment practices.

Implemented consulting solutions

Sasfin BCI Horizon Multi Managed Diversified Growth Fund

The fund aims to offer investors a moderate to high total return over a long-term investment horizon, with a focus on investment growth by investing across asset classes.

Sasfin BCI Horizon Multi Managed Accumulation Fund

The fund aims to accumulate a moderate total return over a medium to long-term investment horizon.

Sasfin BCI Horizon Multi Managed Preservation Fund

The fund aims to deliver a stable level of income combined with capital preservation over a medium-term investment horizon.

Sasfin Horizon Multi Managed High Equity Portfolio

The portfolio aims to offer investors a moderate to high total return over a long-term investment horizon, with a focus on investment growth by investing across asset classes.

Sasfin Horizon Multi Managed Medium Equity Portfolio

The portfolio aims to accumulate a moderate total return over a medium to long-term investment horizon.

Sasfin Horizon Multi Managed Low Equity Portfolio

The portfolio aims to deliver a stable level of income combined with capital preservation over a medium-term investment horizon.

Sasfin Horizon Multi Managed Stable Portfolio

The portfolio aims to provide investment income and capital growth over the long term through investing primarily in local and international equity, fixed interest and cash instruments.

Sasfin Horizon Multi Managed Cash Portfolio

The Cash Portfolio is a low risk money market portfolio that aims to deliver returns in excess of the STeFI consistently over time while ensuring capital preservation, stability and liquidity.

Sasfin Asset Managers has garnered a reputation as one of South Africa’s leading boutique Asset Managers. Their diverse offering has grown to incorporate a range of equity, income and multi-asset class funds designed to suit the needs of discerning retail and institutional investors.

Sasfin BCI Prudential Fund

The Sasfin BCI Prudential Fund is a managed portfolio seeking to deliver long term capital growth and income normally associated with the investment structure of a moderate risk profile retirement fund.

Sasfin BCI Balanced Fund

The Sasfin BCI Balanced Fund is a moderate risk profile managed portfolio. The primary investment objective of the portfolio is to provide investors with a moderate level of income and capital growth over the long term.

Sasfin BCI Stable Fund

The Sasfin BCI Stable Fund is a cautious managed portfolio with the investment objective to achieve above real inflation beating total returns by way of delivering relatively high income with a measure of capital growth over the medium to long term.

Sasfin BCI Flexible Income Fund

The portfolio is an actively managed, flexible income portfolio that effectively makes asset allocation decisions across high yielding asset classes such as preference shares, non-equity securities, fixed interest instruments (including, but not limited to, bonds, corporate bonds, inflation linked bonds, convertible bonds, cash deposits and money market instruments) and assets in liquid form. The portfolio may from time to time invest in listed and unlisted financial instruments. The manager may also include unlisted forward currency, interest rate and exchange rate swap transactions.

Our investment advice process

- Determine investment objectives

- Investment strategy design

- Manager research and blending

- Strategy implementation and assessment

- Investment policy statement development

- Regular monitoring and reporting

- Annual investment strategy review

- Continuous advice process

Need more information?

Give us your details and we will call you back and provide any information you might need.