Expert fund managers at your fingertips

We understand the importance of lasting and sustainable legacies, and pride ourselves in the long-term partnerships we create with the individuals we serve. Our priority is foremost to protect and preserve our clients’ capital, while remaining accessible.

Let's talk

Boutique with a brand

Since its founding in 2002, Sasfin Asset Managers has garnered a reputation as one of South Africa’s leading boutique Asset Managers. Our diverse offering has grown to incorporate a range of equity, income and multi-asset class funds designed to suit the needs of our discerning retail and institutional client base.

Our investment team includes some of South Africa’s most highly-regarded Fund Managers, several of whom have managed large-scale institutional money for decades. This ability to attract top talent has also ensured that the meticulous research produced by our in-house team, coupled by close partnerships with leading global research houses, is always of the highest calibre.

Our Funds

The importance of multi-asset class investing cannot be understated. Globally, the trend in managing one’s holistic wealth is shifting from the focus on a single-asset class focus – i.e. equities or local bonds – towards achieving true portfolio diversification and protected growth through the investment in multiple asset classes.

Sasfin BCI Prudential Fund

The Sasfin BCI Prudential Fund is a multi-asset class managed portfolio seeking to deliver long term capital growth and income normally associated with the investment structure of a moderate to high risk profile investor.

Sasfin BCI Balanced Fund

The Sasfin BCI Balanced Fund is a multi-asset class moderate risk profile managed portfolio. The primary investment objective of the portfolio is to provide investors with a moderate level of income and capital growth over the long term.

Sasfin BCI Stable Fund

The Sasfin BCI Stable Fund is a cautiously managed multi-asset class portfolio with the investment objective to achieve inflation beating total returns by way of delivering relatively high income with a measure of capital growth over the medium to long term.

This type of investing is generally pursued or preferred by investors who require a constant stream of income at recurring intervals as well as capital preservation. Income investing often involves, but is not limited to, fixed-income instruments that pay out in the form of interest or income distribution. Such investments are viewed as more stable and generally considered less risky than other asset classes but they are not riskless. Bonds are the most common type of fixed income asset. An income investment generally comprises three main aspects: income, capital and yield.

Sasfin BCI Flexible Income Fund

The portfolio is an actively managed, flexible income portfolio that effectively makes asset allocation decisions across high yielding asset classes such as preference shares, non-equity securities, fixed interest instruments (including, but not limited to, bonds, corporate bonds, inflation linked bonds, convertible bonds, cash deposits and money market instruments) and assets in liquid form. The portfolio may from time to time invest in listed and unlisted financial instruments. The manager may also include unlisted forward currency, interest rate and exchange rate swap transactions.

Sasfin BCI Optimal Income Fund

The Sasfin Optimal Income Fund is a solution geared towards the investor seeking an attractive low risk, after-tax yield and portfolio liquidity. The Fund is actively managed with the objective of delivering a consistent return with low capital volatility.

Sasfin BCI High Yield Fund

The Sasfin BCI High Yield Fund is an income generating portfolio with the objective to achieve a high level of sustainable income and stability of capital invested.

Sasfin BCI High Grade Money Market Fund

The Fund is a local money market portfolio. The primary performance objective of the portfolio is to obtain as high a level of current income as is consistent with preservation and liquidity.

Equity investing is an essential ingredient required for long-term growth and wealth accumulation. It is, however, also considered a risky asset class as there is a high probability of capital loss that could be experienced over the short-to-medium term. Equity investing must be a long-term consideration to fully appreciate the benefits of this asset class. Equity growth is achieved through price increase as well through dividends which are declared and paid out which can represent a steady income for investors. Equities can be used as a single asset class investment or combined with other asset classes in a multi-asset class solution.

Sasfin BCI Equity Fund

The Sasfin BCI Equity Fund is a specialist managed equity portfolio that invests in high quality, local and global, listed companies. The portfolio’s objective is to maximise returns over time, particularly during periods of weaker equity market growth.

Sasfin Global Equity Fund

The Sasfin Global Equity fund invests in high quality global companies that provide exposure to investment opportunities which capitalise on longer-term investment trends driving growth and changing the world.

Sasfin BCI Global Equity Feeder Fund

The portfolio will, apart from assets in liquid form, invest solely in the participatory interests of the Sasfin Global Equity Fund, established under Sasfin Wealth SICAV, domiciled in Luxembourg. The underlying portfolio invests primarily in global equity securities, property related securities, non-equity securities, money market and other interest-bearing instruments, assets in liquid form, financial instruments as well as participatory interests of underlying portfolios of collective investment schemes or other similar schemes with similar objectives.

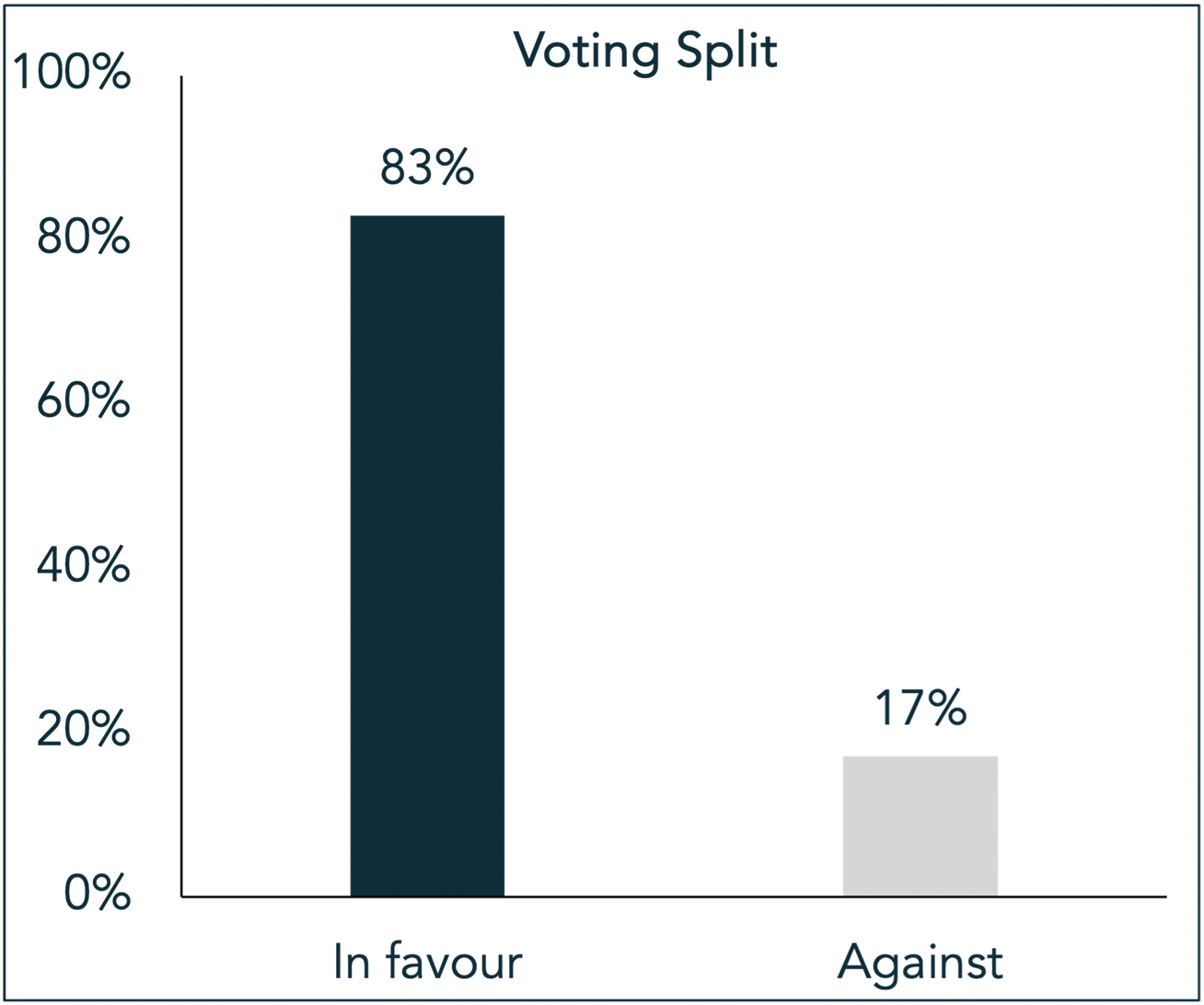

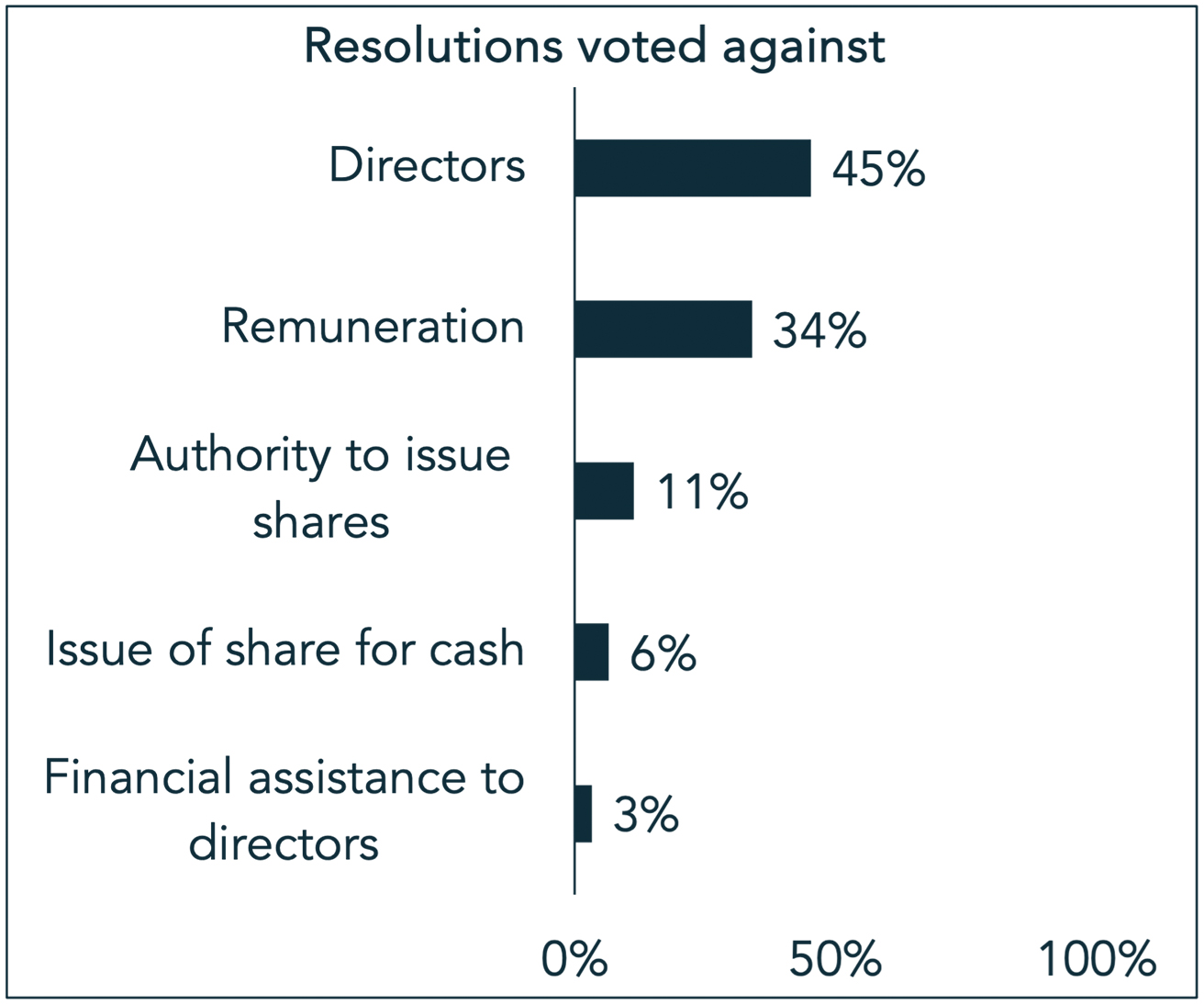

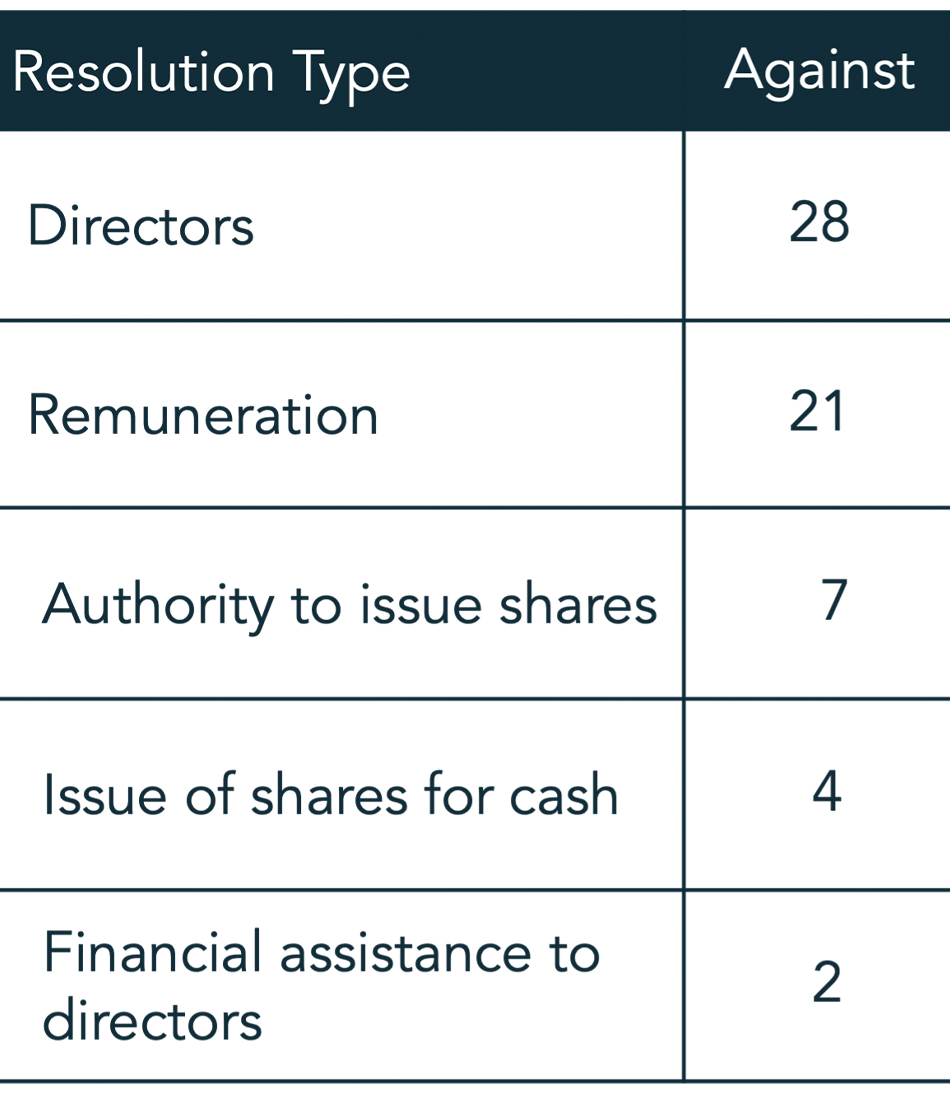

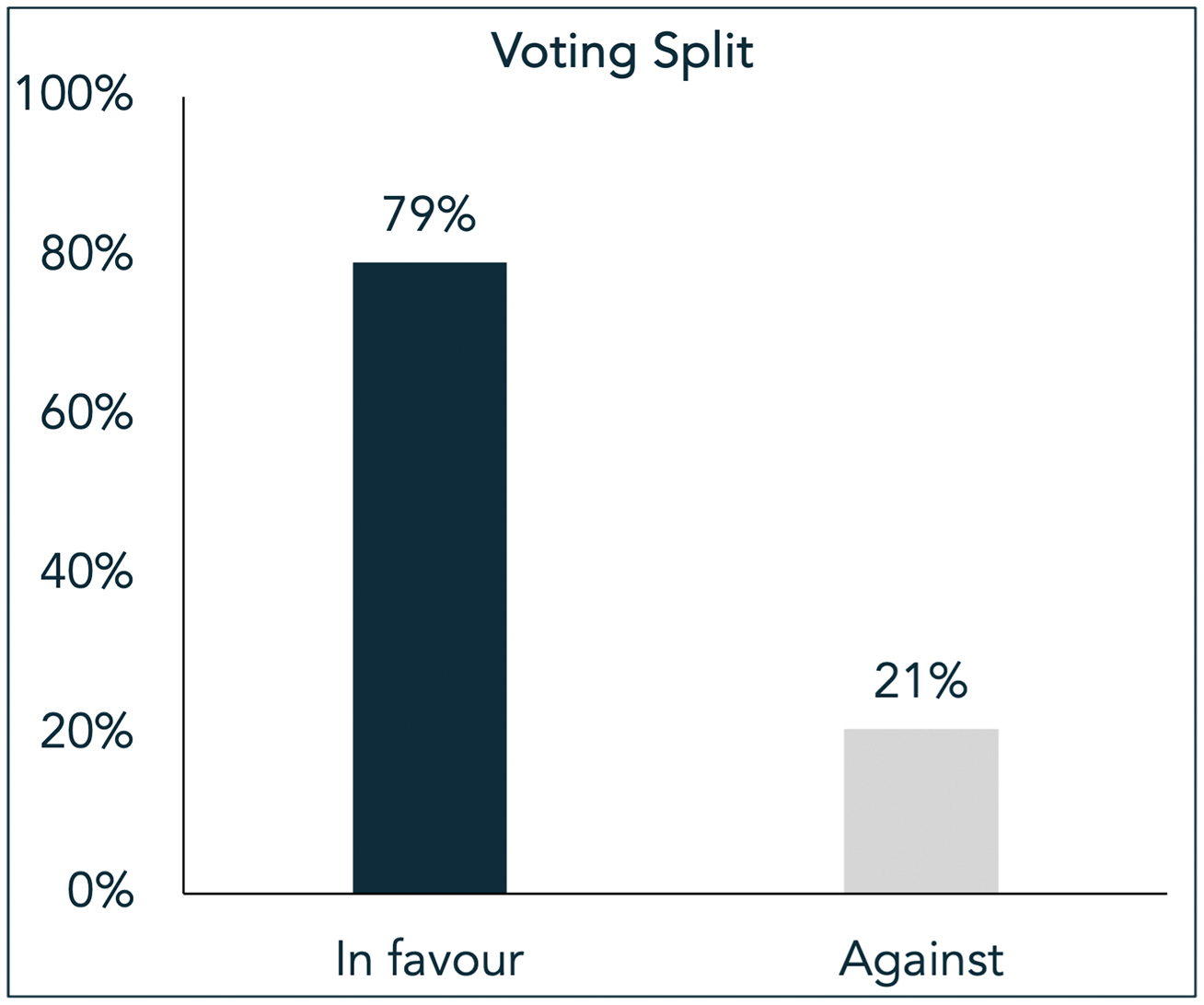

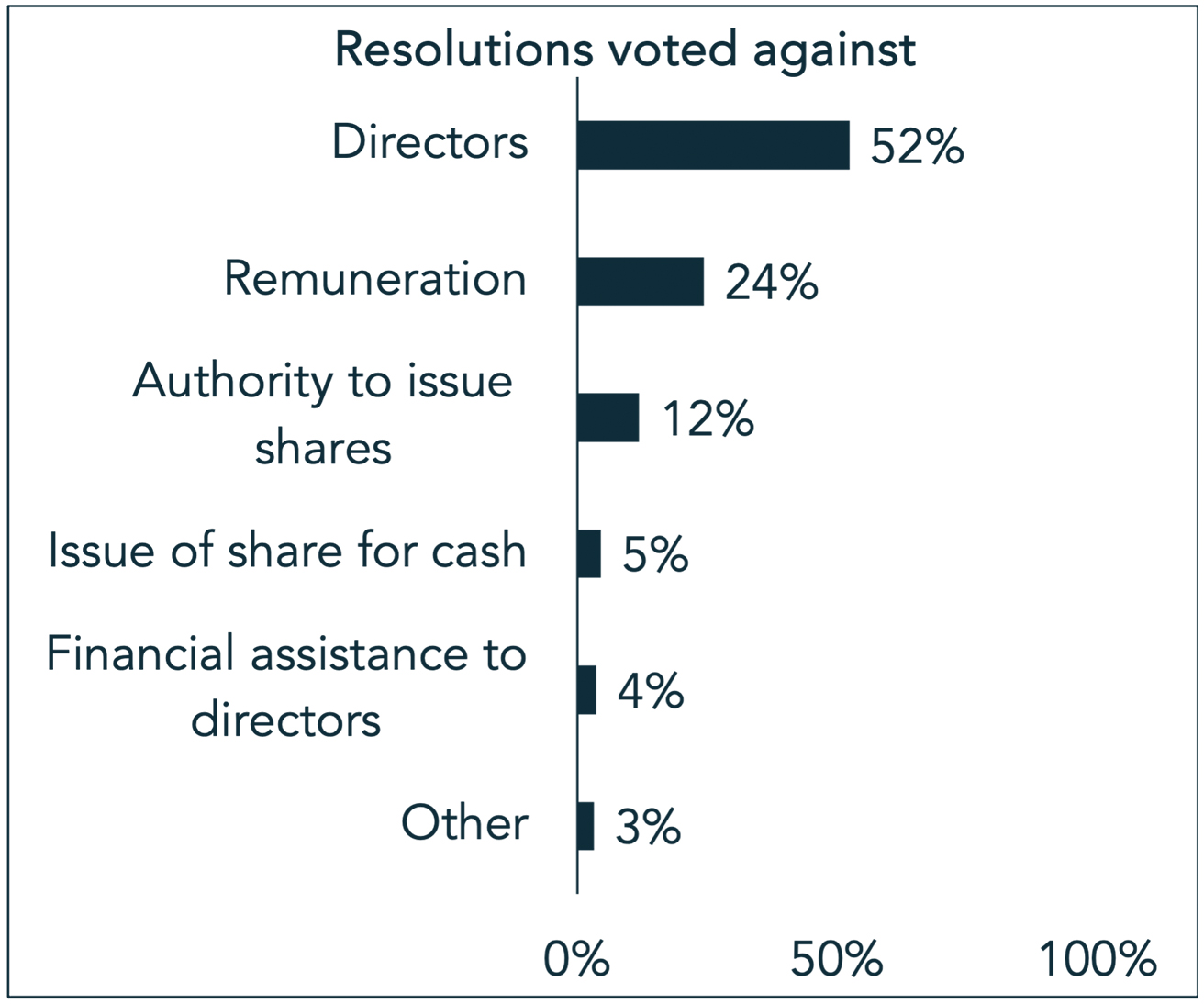

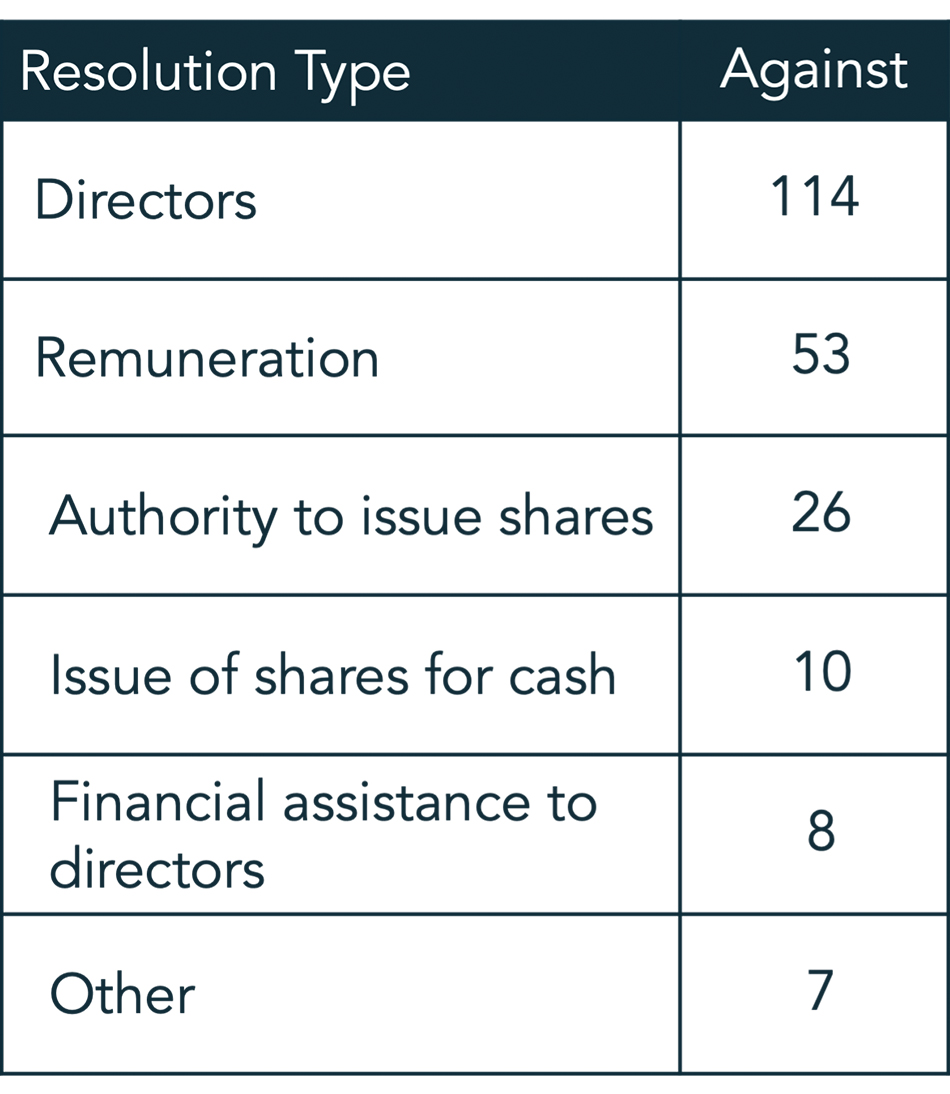

Proxy Voting

As part of our Sustainable journey and thinking at Sasfin Asset Managers, we continue to take an active role when considering corporate governance. Proxy voting is one of the components of the corporate governance process – enabling shareholders to express their views on a vast number of issues. In being responsible stewards towards applying corporate governance principles, we adhere to the Companies ACT and King IV corporate governance code as well as ascribe to the principles of the United Nations and endorse the Code for Responsible Investing in South Africa (CRISA). We believe that good corporate governance enhances long term shareholder value and our actions of voting on proxies on behalf of our clients are geared towards this. Consistent with our mandate of protecting shareholder value, our proxy voting which is premised on our proxy voting guidelines act as a guide in ensuring we safeguard the interests of our clients. The guidelines are not rigid rules as we recognise that in some instances, there will be trade-offs between potential benefits and adverse effects to the company. As such, we will respond to matters on a company-by-company basis all to the benefit of maxisiming the sustaining long term shareholder value of our clients’ investments as they could have a material economic implication. Sasfin Asset Managers remain committed to acting in the best interests of our clients.

Self service forms

Contact a financial advisor today

Contact your financial advisor or a Sasfin financial advisor today to find out more about investing with Sasfin Asset Managers.

Call me back

Your assets are in award winning hands

Meet the team

Our formidable investment team has developed a sound investment philosophy, combining thorough fundamental research, spanning various asset classes with focused analysis of global macroeconomic trends.

Raphi Rootshtain

Portfolio Manager, Asset Management

Sinenhlanhla Mkhize

Business Development Manager (Private Clients)

Siphokazi Melamane

Business Development Manager (Institutional)

Sumaya Hassen

Business Development Manager (Institutional)

Mokgadi Skwambane

Head: Corporate Business Development

Bhekabantu Ngubane

Head: Institutional Business Development

Contact a financial advisor today

Contact your financial advisor or a Sasfin financial advisor today to find out more about investing with Sasfin Asset Managers.